Empowering

Your Business with

Smarter Banking

Accounts

Tailored to meet the specific needs of your business, whether you’re a startup, SME or corporate.

- Checking Accounts

- Fixed Deposit Accounts

- Real Estate Escrow Accounts

- Client Money Accounts

Loans and Financing

Mbank offers a range of loans and financing solutions to help businesses manage cash flow, invest in opportunities, and expand.

- Working Capital Loans

- Term Loans

- Commercial Mortgages

- Small Business Loans

- And more…

Running your Business

Business / Corporate Cards

Swipe with Confidence. Manage with Ease.

Our Mbank Business Debit Card streamlines financial transactions, giving you more control over your business spending.

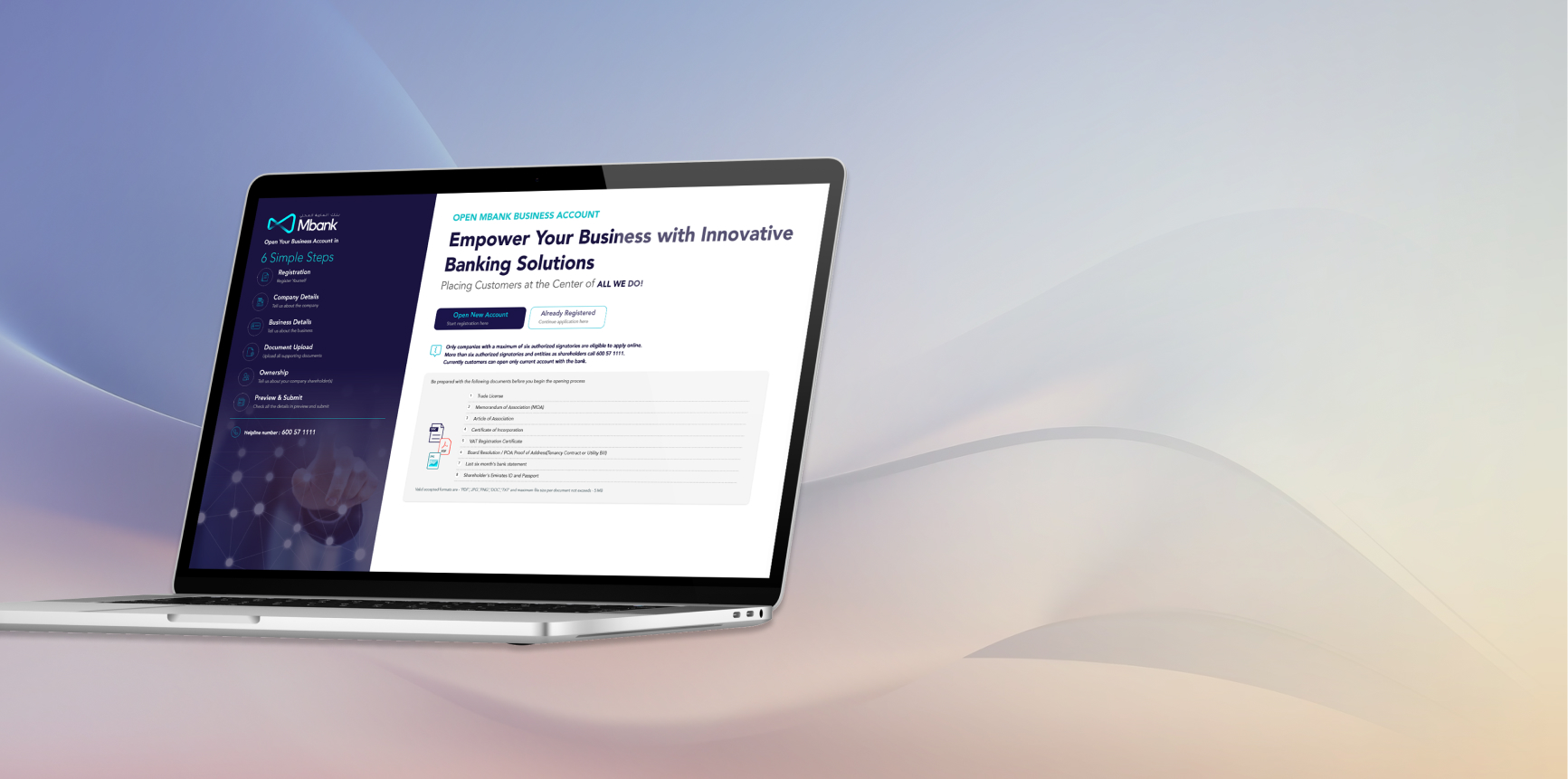

Your Journey Begins Here

Check your eligibility and complete your application in just a few clicks—no paperwork, no hassle.

We welcome all startups, SMEs and corporates registered in the UAE with a valid trade license, including freezones, to open a Business Account at Mbank.

Applying Is Easy—Success Comes Next

Discover how our corporate banking solutions can help your business grow and succeed.