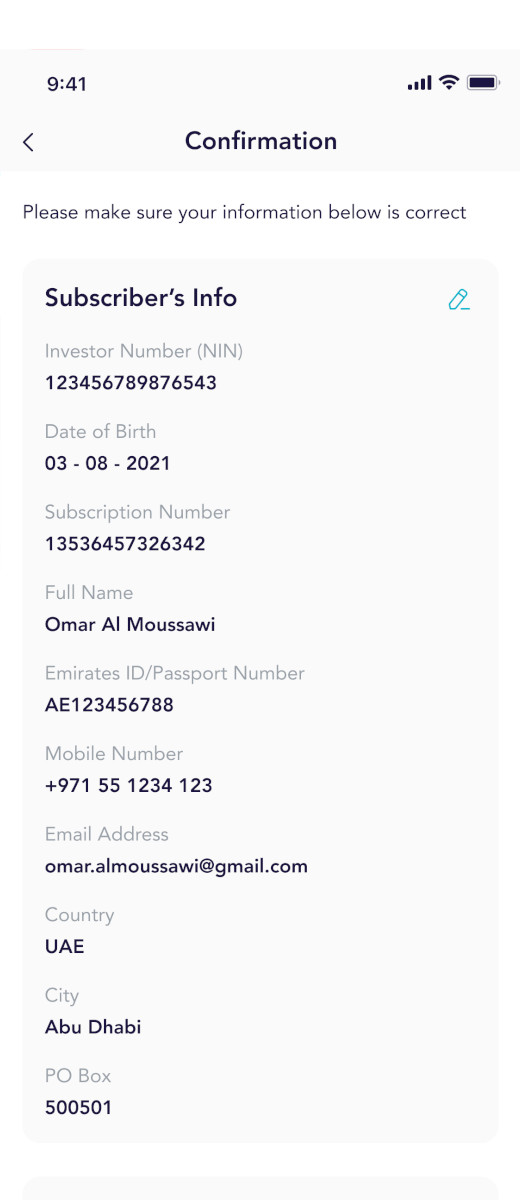

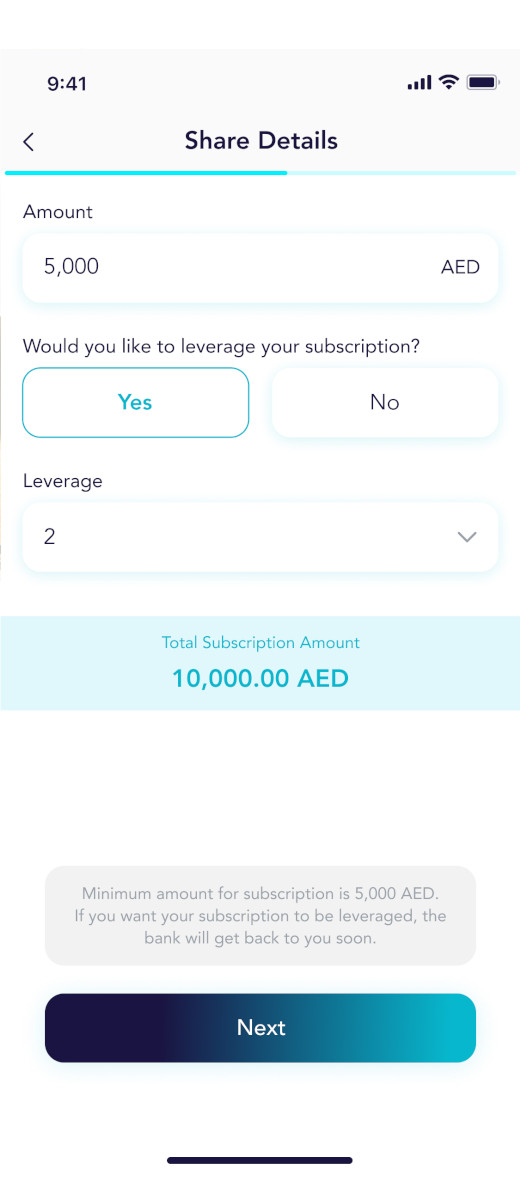

Disclaimer: Al Maryah Community Bank LLC is only a receiving bank – Initial Public Offering. We are not involved in the offering, solicitation, recommendation, commenting, or providing any guarantee to any individual or entities participating in the IPO. You should undertake your own research and study before you trade or invest. You should carefully consider whether trading or investment is suitable in light of your own financial position and investment objectives. You are advised to seek independent financial and professional advice before you trade or invest. You should seek independent professional advice if you are uncertain of or have not understood any aspect of the following risk disclosure statements or the nature and risks involved in trading or investment.