Get answers to common questions about Business Debit Card

How can I apply for a Mbank Business Debit Card?

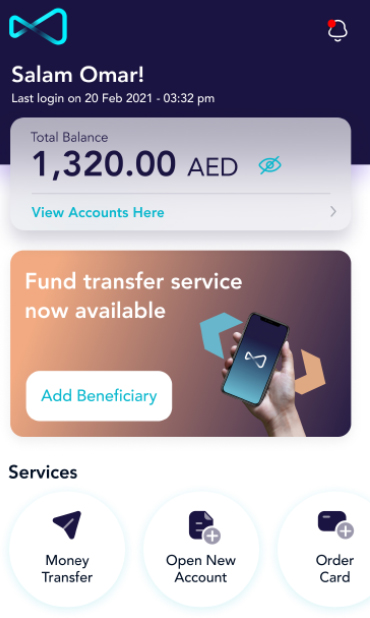

Business Customers can apply for a Mbank Business Debit Card through their Mbank Internet Banking account or Mbank Business App. Simply log in, navigate to the Debit Card tab, and follow the steps in the application process.

Who bears the liability of all Debit Cards issued to a company?

The company / authorized signatory is fully liable for all Business Debit Cards issued under the Company.

Is there a fee for the Mbank Business Debit Card?

Mbank Business Debit Cards are currently free and so are additional cards under the same account.

Is there a fee for replacement/stolen Business Debit Cards?

Yes, the charge is AED 25 +VAT. Please refer to our fee schedule for more details.

Which name will be embossed on the Business Debit Card?

The customer has the choice of mentioning a personal name or the company’s name (not both) on the Business Debit Card.

Are there any limits on the Business Debit Card?

Default limits are set for POS and E-Commerce at AED 150,000 and Cash Withdrawals at AED 100,000, which can be increased or decreased via the Mbank Internet Banking Portal.

How can I customize spending limits on my Mbank Business Debit Card?

Business owners have the flexibility to manage spending limits and control expenses and withdrawals by adjusting card limits directly through the Mbank Internet Banking Portal.

How can I activate my Mbank Business Debit Card?

You can activate your Mbank Business Debit Card by following the instructions provided with the card or by visiting Mbank’s Internet Banking Portal or Mbank Business App in the “Cards” section.

What should I do if my Mbank Business Debit Card is lost or stolen?

If your card is lost or stolen, the First Card holder / Owner has to contact Mbank immediately to report it or block the card from the Mbank Internet Banking Portal. A replacement card will be issued automatically when the card is reported stolen or lost.

What are the necessary precautions to keep the Mbank Business Debit Card safe?

- Review the Business Banking account through the Mbank Internet Banking Portal.

- Block the Card using Mbank’s Internet Banking Portal in case an employee resigns or gets terminated.

- Block the card immediately using Mbank’s Internet Banking Portal in case of a lost or a stolen card.

How do I apply for a replacement card?

You can apply for a replacement card by raising a new card issuance request over Mbank’s Internet Banking Portal.